4 Best No-Penalty CD Rates in July 2025: Earn Up to 4.00% APY

If you can afford to lock up some money for a few months or longer, these CDs offer the best value

Key Takeaways:

No-penalty CDs are more flexible than traditional certificates of deposit because you won’t be charged a fee for withdrawing funds before the term ends.

But there’s usually a waiting period before you can pull your funds, or you might only be allowed to withdraw some of your money.

No-penalty CD APYs are similar to those on high-yield savings accounts, but the interest rate won’t change during a CD term like it can with a savings account.

Stashing your money in a savings account can net you a decent return, especially if it's a high-yield savings account. But if you don't need access to the money anytime soon, you may find a higher interest rate on a certificate of deposit (CD) at some banks and credit unions.

Traditional CDs are higher-yielding accounts that come with a catch: To take advantage of the higher, low-risk annual percentage yield (APY), you can't take money from the account until it reaches maturity, which can take anywhere from three months to five years in most cases.

If you take a withdrawal before the account matures, you'll be subject to an early withdrawal penalty, which can amount to several months' worth of interest. Fortunately, no-penalty CDs are on the rise, allowing account holders to take that withdrawal, albeit with some limitations, without a fee.

Here are some of the best no-penalty CD rates from both brick-and-mortar and online banks. Note that these rates are current as of July 2025.

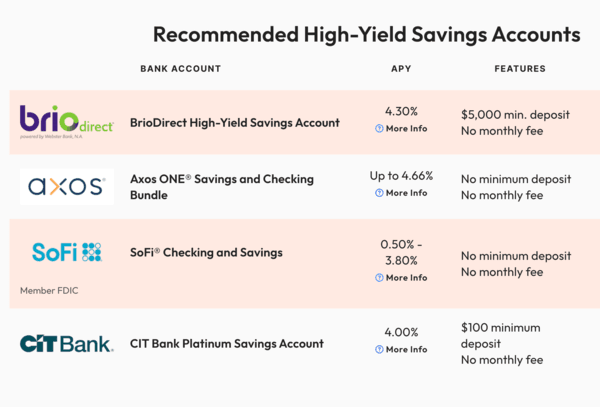

Before you look into CDs, check out other high-yield accounts, including savings accounts and money market accounts, to see if you can get a similar rate without locking up your money for several months. Many banks offer bonuses for new account openings to incentivize new customers. Also check that the bank is FDIC insured so you know your funds are secured. Most banks are considered safe but it's always a good idea to double check.

If you can't find another high-yield option you like, consider these features when determining which CD is the right fit for you:

CD rates

Maturity date

Opening deposit requirement

Compounding period

Full or partial withdrawals

Restrictions on when you can withdraw

Ability to renew

Rate guarantee

In addition to these banks and credit unions, you may also want to consider other CD providers, including CFG Bank, PurePoint, Quontic Bank and more. Keep in mind, though, that not all financial institutions that offer CDs have a no-penalty option.

If you're the type of person who likes to keep all of their financial dealings under one roof, you may also want to check to see what other financial products and services the financial institution offers.

Are No-Penalty CDs Worth It?

No-penalty CDs are worth it if you find one with an APY you like and that has the flexibility you need. If you think you'll need to withdraw your funds early, read the rules of the CD and if the restrictions work for you, then a no-penalty CD could be worthwhile.

Typically, a no-penalty CD isn't worth it when you are certain you won't need to touch your funds for the length of the CD term because you can often find a higher APY elsewhere, whether in a traditional CD or a high-yield savings account. A no-penalty CD is also often not worth it if you want to deposit funds from time to time—you'll want a high-yield savings account for that scenario.

Consider the following recommended CD rates below:

Comments

No comments yet.